|

| Probate services Nigeria |

The loss of a loved one is emotionally challenging, and dealing with legal matters during such a period can be overwhelming. In Nigeria, probate services play a critical role in managing and distributing the estate of a deceased person. Understanding the probate process helps families avoid unnecessary stress, legal complications, and disputes. This article provides a complete guide to probate services in Nigeria, covering key concepts, procedures, timelines, and how professional help can make a difference.

What Is Probate?

Probate is a legal process through which a deceased person’s will

is validated and their estate is managed according to the terms of that will

(if it exists). If there is no will, the estate is distributed according to

Nigerian inheritance laws under the Administration of Estates Law or

applicable customary law.

The purpose of probate is to:

- Authenticate the will of the deceased (if available)

- Appoint executors or administrators

- Settle any outstanding debts or taxes

- Distribute the remaining assets to beneficiaries

When Is Probate Required in Nigeria?

Probate is necessary when:

- The deceased has left a valid will (testate)

- The deceased did not leave a will (intestate),

and there are assets to be distributed

Whether or not there is a will,

probate is legally required before the deceased’s properties (like land,

houses, bank accounts, shares, or vehicles) can be accessed or transferred.

Types

of Probate Services

There are generally two types of

probate services in Nigeria:

1.

Grant of Probate

This applies when the deceased left

a valid will. The executor named in the will applies to the probate registry to

obtain a Grant of Probate, which gives them legal authority to manage

and distribute the estate.

2.

Letters of Administration

This applies when the deceased did

not leave a will. In such cases, a family member or next of kin applies for Letters

of Administration to be appointed as the estate administrator.

Key Steps in the Probate Process in Nigeria

1.

Locating the Will

If a will exists, it is typically

lodged at the Probate Registry or kept by a trusted lawyer. The executor named

in the will is responsible for initiating probate.

2.

Application to the Probate Registry

The executor (or administrator)

applies to the Probate Registry in the relevant jurisdiction (usually

where the deceased lived). Required documents include:

- The original will (if any)

- Death certificate

- Inventory of assets and liabilities

- Completed probate application forms

3.

Publication of Notice

The Probate Registry publishes a

notice in the newspaper to invite objections from the public. This is to ensure

transparency and allow any objections or claims against the estate.

4.

Valuation of Estate

All assets are valued, and

appropriate estate duties or taxes are calculated. In Lagos State, the Probate

Registry works with the High Court to determine the estate’s value.

5.

Grant of Probate or Letters of Administration

If no objections are received and

the process is in order, the court issues either:

- A Grant of Probate (if there is a will), or

- Letters of Administration (if there is no will)

This document authorizes the

executor or administrator to distribute the estate.

6.

Distribution of Assets

The executor or administrator pays

any outstanding debts and distributes the remaining assets to the rightful

beneficiaries as per the will or inheritance law.

Timeline

for Probate in Nigeria

The duration of the probate process

in Nigeria depends on various factors, including the complexity of the estate,

presence of a will, number of beneficiaries, and whether disputes arise. On

average:

- Simple probate cases:

3 to 6 months

- Complex or contested estates: 6 months to 2 years

Delays are often caused by

incomplete documentation, family disputes, or legal objections.

Common

Challenges with Probate in Nigeria

1.

Lack of

Awareness: Many families are unaware that

probate is required to access a deceased person’s assets.

2.

Family

Disputes: Disagreements over property or

inheritance can slow down or derail the process.

3.

Forgery or

Multiple Wills: Cases of forged documents or

multiple versions of wills can lead to litigation.

4.

Delays in

the Court System: Bureaucratic procedures and

understaffing at probate registries often result in long delays.

5.

Untraceable

Assets: In some cases, beneficiaries are

unaware of all the assets owned by the deceased.

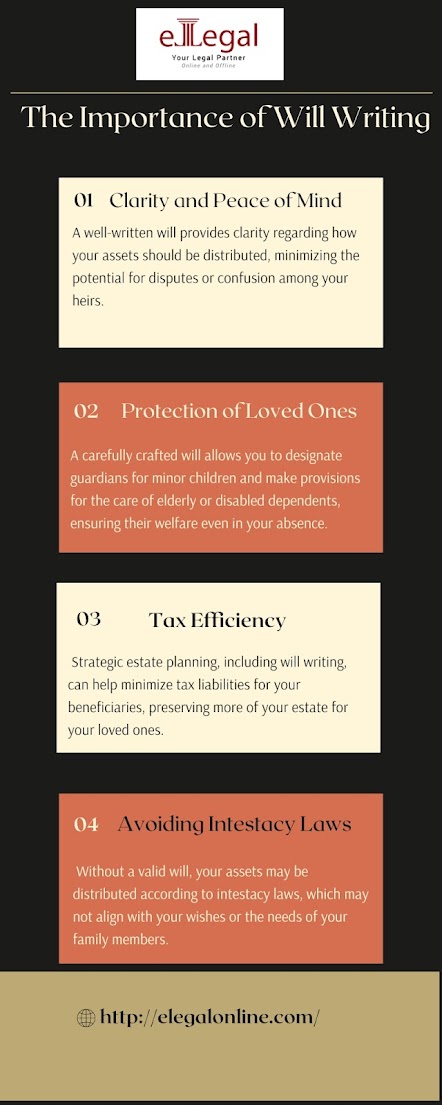

Why

You Need Professional Probate Services

Handling probate on your own can be

time-consuming and legally complex. Engaging a professional legal service or

probate consultant can:

- Ensure all legal requirements are met

- Help prepare accurate documentation

- Speed up the probate process

- Resolve conflicts with other beneficiaries

- Provide legal protection and peace of mind

eLegal Consultants offers reliable and professional probate services to guide

you through every step of the process—whether you’re dealing with a will or

seeking letters of administration. Their team helps you avoid costly mistakes,

meet legal deadlines, and settle estates with minimum stress.

Cost

of Probate Services in Nigeria

The cost of probate in Nigeria

includes:

- Legal fees

- Probate Registry fees

- Publication charges

- Valuation costs

- Estate duties

(taxes)

Probate Registry fees are usually

calculated as a percentage of the total value of the estate. Legal and

professional service fees vary depending on the law firm or consultant you

hire.

Frequently

Asked Questions (FAQs)

Q1:

Can I sell a deceased person's property without probate?

No. You must obtain a Grant of

Probate or Letters of Administration before selling or transferring

any property legally owned by the deceased.

Q2:

What happens if more than one will exists?

The most recent valid will is

recognized. If there is doubt or suspected forgery, the matter may be resolved

in court.

Q3:

What if the deceased had assets in different states?

You may need to obtain probate

resealing—a legal procedure that allows a grant issued in one state to be

recognized in another.

Q4:

Who can apply for Letters of Administration?

Usually the next of kin, such as a

spouse, child, sibling, or parent. In some cases, multiple family members may

apply jointly.

Q5:

Can probate be done online?

While the full process is not yet

fully digitized in Nigeria, some aspects—like form submissions or consultation

with legal experts like eLegalOnline—can be done virtually.

Final

Though

Probate services are essential for

the smooth and legal transfer of a deceased person’s estate in Nigeria. Whether

there’s a valid will or not, the law requires specific procedures to be

followed before assets can be distributed. While the process can be complex,

seeking help from experienced legal professionals simplifies the journey,

protects your interests, and ensures that the wishes of the deceased are

honored.

For families navigating this

difficult time, probate services offer not just legal support—but peace of

mind.

Need assistance with probate in

Nigeria? Consider reaching out to a trusted

legal advisor or professional service like eLegal Consultants in Nigeria

for confidential and efficient support.